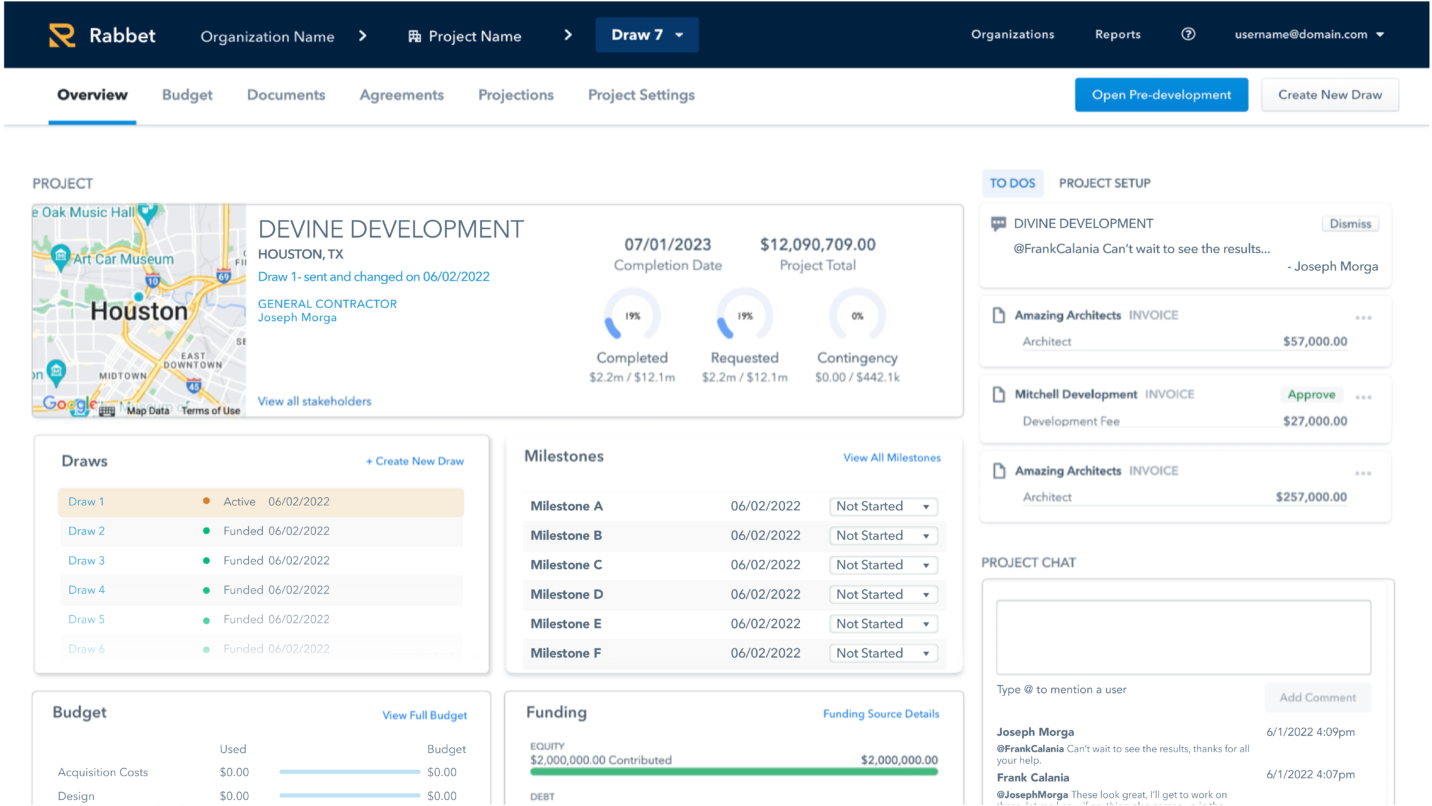

CONSTRUCTION CASH FLOW MANAGEMENT SOFTWARE

Track Construction Cash Flows Accurately and Automatically

Tracking cash flow on a project is critical to ensuring the project is staying on track, meeting pro forma expectations, and capital calls are properly predicted. Rabbet centralizes your actual cost data with your projection to see real time insights into progress while automating new projections as costs are incurred.