Reflecting on 2023, Looking Ahead to 2024

Twelve months ago, I reflected on the difficulties in investing in CRE due to the uncertainty in the market and current status of the T-bill in my white paper “Maximizing... Read More

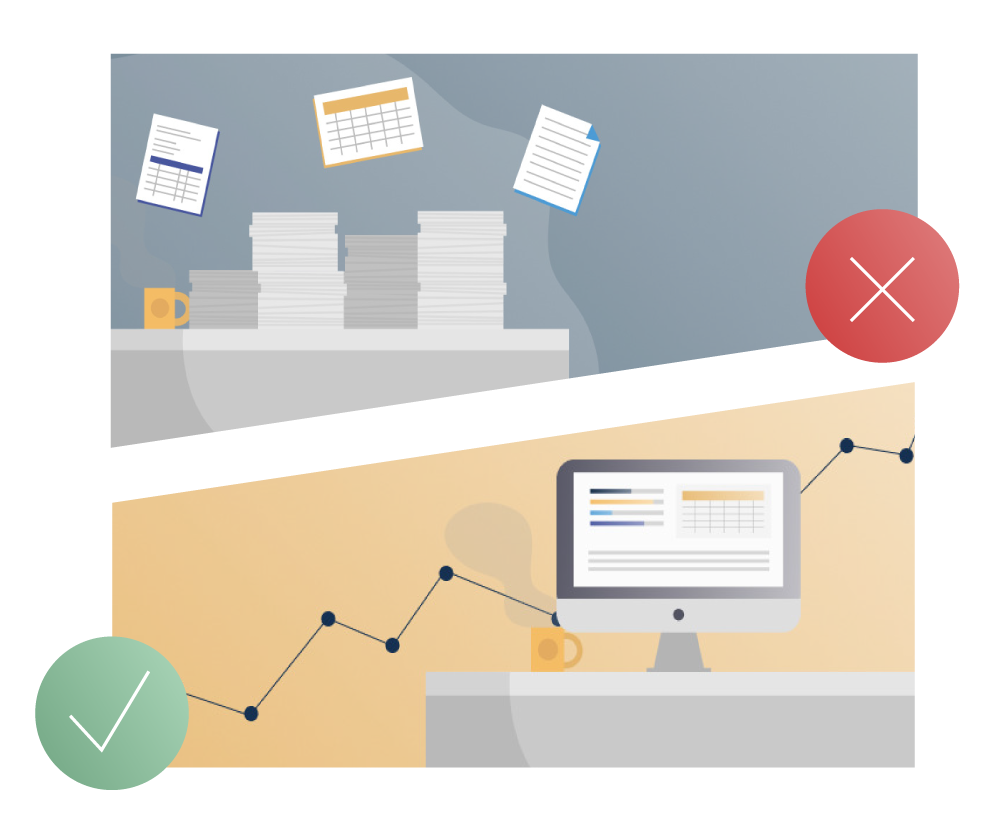

Many lenders rely on analysts and excel reports to get updates on project status. While that solution works for some things it is difficult to quickly assess portfolio risk when issues arise, such as a subcontractor going out of business. By bringing your project information into a centralized platform you mitigate that risk and save everyone time. For example, with the subcontractor issue you could quickly identify all projects where a vendor is involved by simply opening your loan management platform.

You need to make sure your platform allows you to track vendors across projects and instantly gain visibility into your exposure. Similarly, the reporting solution you implement should allow you to look at all projects from a summary view to spot issues with project completion. By creating a centralized source of truth you reduce the need for one-off reports and your data becomes exponentially more malleable and transparent. Your team will automatically have access to many portfolio metrics that previously required manual work to track (project status, regional reporting, funding sources remaining, contingency left, etc.) or that you weren’t able to track at all (vendor exposure across your portfolio).

Aside from visibility, your team needs a configurable reporting solution. If team members can’t customize their views to see the data they need most, your team is losing hours of time building reports instead of analyzing them. Ensure each team member can gain quick access to the unique metrics they need without having to export or restructure data each and every time.