Reflecting on 2023, Looking Ahead to 2024

Twelve months ago, I reflected on the difficulties in investing in CRE due to the uncertainty in the market and current status of the T-bill in my white paper “Maximizing... Read More

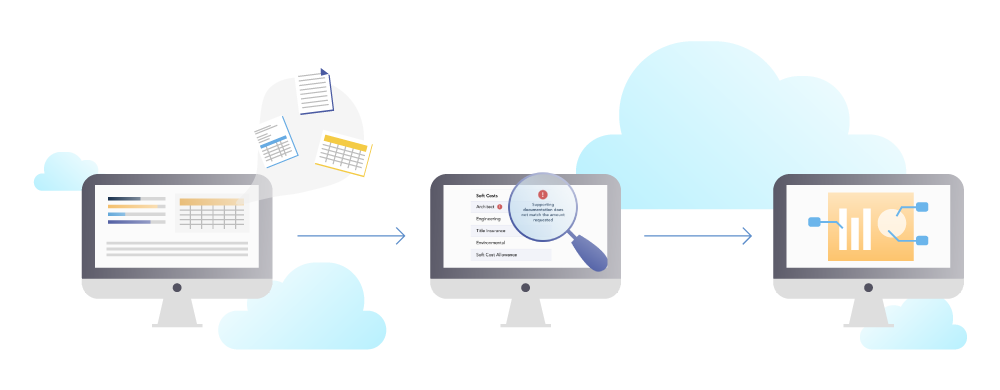

First and foremost you need to digitize your process. But hold on, before you go out and buy a smartwatch or start studying computer science on the weekends, start simple. List out the steps of your current draw process and identify which steps take the most time. You’ll probably find that much of your time is spent waiting for colleagues to send you documents, asking for clarification on line items, or manually delivering documents to someone and waiting for approval. You might even realize that you lose the most time when, after hours of work, you notice the borrower sent you an incorrect document and you need to start over…at 5:30pm…on Friday.

Digitizing your workflow addresses those issues while increasing loan servicing quality and borrower satisfaction. So how exactly do you do that? The first step is moving your loan management process from siloed spreadsheets to a cloud based solution. Implementing cloud based software eliminates many redundant steps and document transfers that waste time and expose the lender to unnecessary risk. With a digital solution every employee follows the same standardized workflow. That consistency boosts loan servicing quality and provides a digital record for verifiable compliance.