CONSTRUCTION LOAN SERVICERS

Excel Slows Loan Servicing and Reduces Transparency

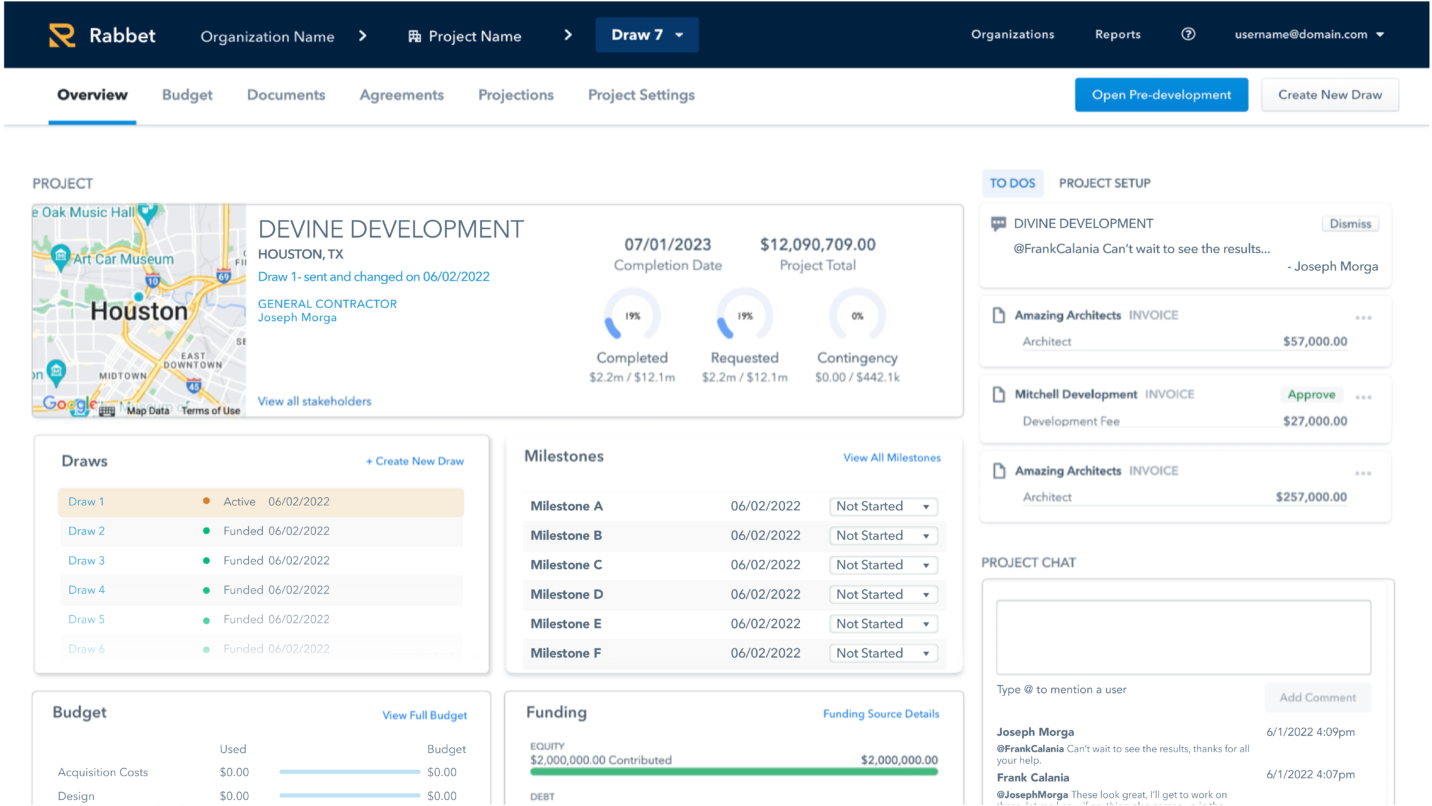

We Solve That Problem

Relying on Excel and email to manually track draw requests, manage documents, and reconcile data slows your team down, leading to funding delays and a lack of transparency for clients.

Loan servicers turn to Rabbet to centralize data, automate processes, and gain real-time loan and portfolio visibility. With Rabbet, streamline operations, enhance client satisfaction, and handle more loans—while minimizing risk and ensuring compliance.