Cost Overruns In Construction

According to industry research, 85% of construction projects experience cost overruns. Customers using Rabbet on the contrary experience cost overruns on only 25% of projects. In the world of real estate development, budgeting accurately is crucial for the success of any project. Traditionally, developers have relied on a standard contingency of 5% for ground-up developments and 10% for renovation projects to cover unforeseen costs. However, as the complexity of projects and data we have accessible has evolved, so too should our approach to budgeting contingencies.

What Is Contingency?

Contingency generally refers to an amount of money that is set aside for a future event or circumstance that is possible but cannot be predicted with certainty. While we know we have items that we have not fully predicted in our budget. Contingency provides the cushion needed to prevent cost overruns due unexpected events.

How Is It Used?

Contingency is primarily used for the items that are the most difficult to predict. There are often more unknowns when you’re renovating a project than during new construction, where items are mostly known after the foundation work is complete.

Therein, here are the primary causes of unknown costs:

- Scope Creep / Design Changes: Adding new features or expanding the project scope beyond the original plan without adjusting the budget.

- Labor Availability / Schedule Management: A lack of skilled labor can lead to delays and increased labor costs.

- Unforeseen Conditions: Unexpected issues like soil instability, contamination, or hidden utilities that require additional work.

- Poor Project Management: Inefficient coordination, communication, or decision-making processes that lead to delays and cost overruns.

- Buyout Busts / Material Cost FluctuationsThe Need for a New Approach: Changes in the prices of materials due to market conditions, tariffs, or shortages.

These factors often interact to cause compounding, unforeseen issue, which leads to poor management, and then to schedule delays. Having money available to address these issues can ensure the project finishes on time and on budget.

The Need For A New Approach

The conventional wisdom of a fixed percentage fails to account for the nuanced differences in project sizes and their respective risks. A more tailored approach to contingency budgeting can lead to more precise financial planning and better project outcomes. Using a tool like Rabbet, you can look at contingency breakdowns across your portfolio to see how different sizes and projects have had various cost overruns.

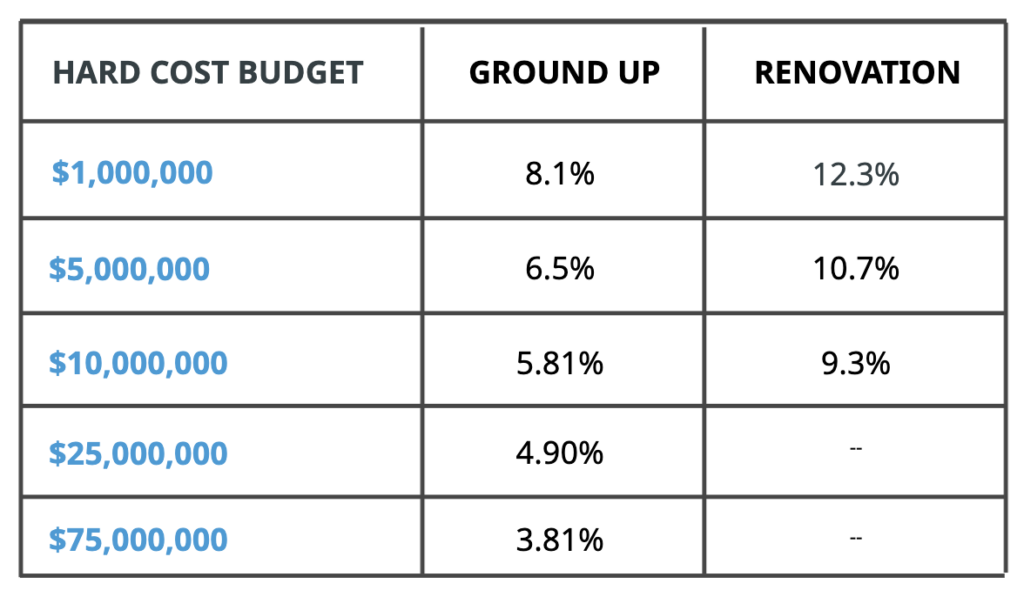

The Contingency Recommendation Table

Below is a table that outlines the suggested percentages based on the total project budget. This graduated scale ensures that larger projects, which typically have more established risk management practices, can operate with a lower contingency percentage, while smaller projects retain a higher contingency to buffer against their relatively higher risk exposure.There are often more unknowns when you’re renovating a project than during new construction, where items are mostly known after the foundation work is complete.

Why This Approach Works

In reality, a project with twice as many costs doesn’t by default have twice as much uncertainty. Therein, scaling the contingency based on project size is a good starting point. Using robust data in your portfolio to understand other key impacts on contingency needed can be valuable: project type, location, square footage, etc. We recommend a more nuanced approach for the following reasons:

- Scalability: This method recognizes that as project budgets increase, the proportion of funds required to cover unforeseen expenses can reasonably decrease. Larger projects benefit from economies of scale and often have more comprehensive risk management strategies in place.

- Risk Management: Smaller projects inherently carry higher risks per dollar spent, making a higher contingency percentage appropriate. Conversely, larger projects typically have more resources and better risk mitigation practices, allowing for a lower contingency percentage.

- Financial Precision: By adopting a sliding scale for contingencies, developers can more accurately forecast and allocate funds, leading to improved financial planning and project execution.

This of course is just a recommendation. Using your own project data, you are able to establish even more detailed contingency models over time.

Implementing The New Contingency Framework

Adopting this new contingency recommendation requires a shift in mindset and practice. Developers should:

- Review Past Projects: Analyze historical data to understand how contingency funds were utilized in projects of varying scales.

- Tailor to Project Specifics: Adjust the recommended percentages as necessary based on specific project conditions, such as location, complexity, and regulatory environment.

- Continuous Monitoring: Implement robust project monitoring and control processes to ensure that contingency funds are used effectively and efficiently.

More contingency means more financing required for the project. However, the negative reputational impacts of going over budget also exist. Tip toeing a fine line to establish confidence in your contingency can be accomplished with good data.

Conclusion

The era of one-size-fits-all contingency budgeting is over. By adopting a graduated contingency scale, real estate developers can better manage project risks, optimize their budgets, and enhance the likelihood of project success. This tailored approach not only reflects the realities of modern construction projects but also promotes smarter financial planning and risk management.

Transitioning to this new model will require careful consideration and adaptation, but the benefits of more accurate budgeting and improved project outcomes are well worth the effort.

If you’d like to get an even more detailed breakdown of the contingency table, set up time to chat with our team:

Jump To