From Excel Overload to Automation: Enhancing Risk Management in Real Estate Development

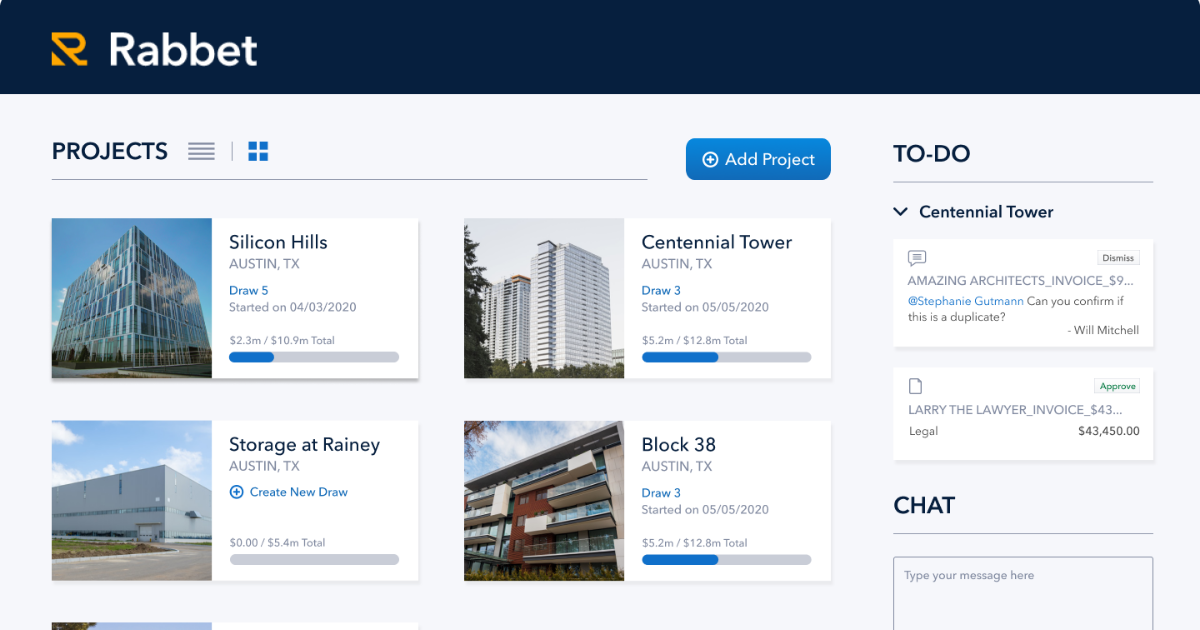

Developers are united in one universal struggle: Excel. Excel is the industry standard tool in Commercial Real Estate. It’s the most widely used program for both lenders and developers but the least favorite program or tool for both groups. Excel’s…