Twelve months ago, I reflected on the difficulties in investing in CRE due to the uncertainty in the market and current status of the T-bill in my white paper “Maximizing Returns in CRE….”. And most of the market uncertainty outlined in the paper prevailed throughout the year, specifically:

- The T-Bill remains near 15-year highs, after peaking in November 2023

- Asset pricing remains volatile, especially in Commercial

- Cap Rates persist at the highest level in over a decade

As I theorized, leading CRE firms would use this period of uncertainty to invest in technology to shore up operations, with over 60% of firms choosing to invest in technology to streamline operations . This development is often driven by the need to ensure greater CONNECTION and CONTROLS within your organization as well as provide visibility to understand costs and status in real-time.

Rabbet’s Strategic Focus to Best Serve the Industry, Now and in the Future

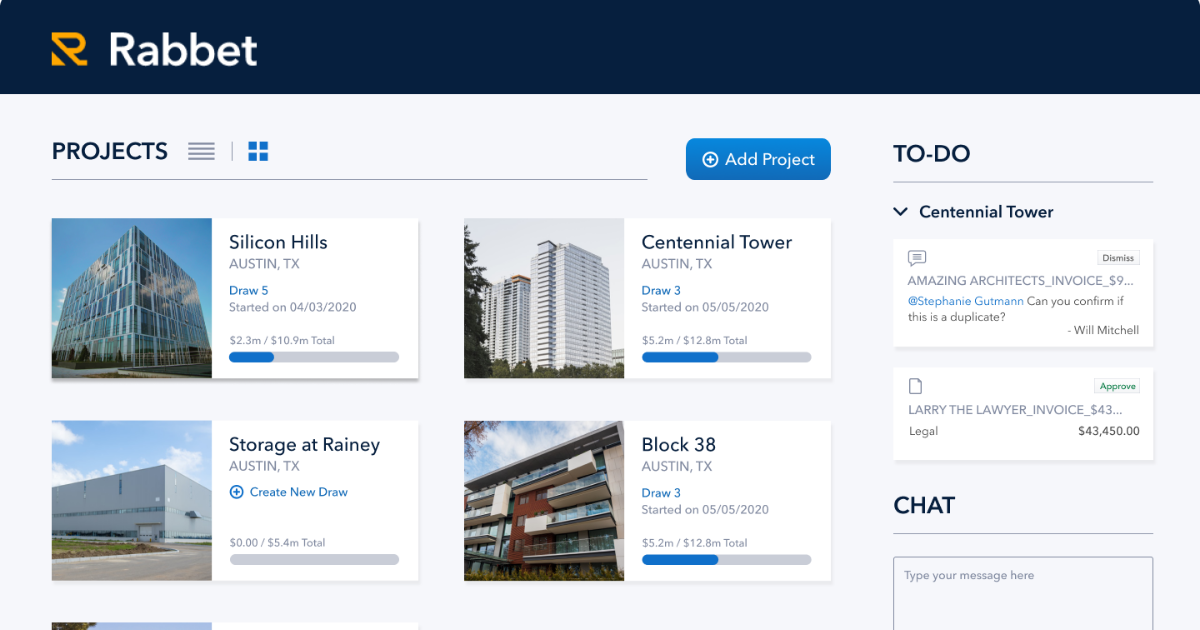

By focusing on the current needs of our customers, Rabbet invested in product introductions and enhancements that would deliver greater confidence in your ability to be strategic during these unprecedented times. Our roadmap focused on:

Strengthening Connections:

Whether you were looking to better align with external stakeholders or with your internal accounting team, Rabbet invested in key enhancements to eliminate delays, double entry, and errors related to manual entry, most notably through our recently-announced Rabbet Connect functionality.

Extending Controls:

Whether you wanted richer status of draws or more nuanced tracking of document approvals, Rabbet extended these capabilities to ensure that items were being processed quickly and accurately.

Status of Costs:

Through our additional investments in payment status, dashboard updates, and anticipated expenditure reporting, Rabbet provides visualizations to ensure that you quickly understand real-time costs and the impacts on your project budget.

While we cannot eliminate uncertainty in the market, by strengthening connections, extending controls, and delivering real-time status, Rabbet enables our customers to be more confident, collaborative, and efficient when managing their projects this year.

Will’s 2024 Outlook for the CRE Industry

This year will see the Beta (measurement of investment volatility) decrease as a result of the mitigation of uncertainty in interest rates and a lowering of construction costs. However, land costs and debt markets will continue to be factors that contribute to ongoing CRE difficulties.

Uncertainty in Interest Rates Subsides:

The 10-year treasury has already fallen off October highs and will continue to fall as the Fed has indicated three rate cuts in the upcoming year. As the first expected rate cut in March arrives, interest rates should continue to fall and correspondingly cap rates will lower; which in turn, expense pressures on existing assets will subside.

Construction Costs Continue to Lower:

With construction spending declining in 2024, contractors who had long backlogs of projects will now be more willing to compete for projects to keep their crew busy. The imbalance of supply and demand, combined with lowering inflation and higher unemployment, will most certainly ease the market uncertainty. This will likely also affect the cost of construction projects.

With the uncertainty surrounding interest rates and construction costs subsiding as we move deeper into 2024, the two limiting factors for development will likely come down to land costs and capital supply.

Land Costs:

Many owners still have not accepted their land is no longer what it was worth in 2022. And many landowners have ample time to wait out the market return. The reality is that 2021 land prices will not be seen again anytime soon. Until owners accept that land prices have fallen, projects will be tough to pencil.

Capital Supply:

Even if developers are able to pencil deals, capital that is caught up in pre-2022 assets will remain difficult to free up. With the 10-year treasury likely to remain above cap rates of several existing assets, assets (especially in commercial real estate) will remain underwater. Until equity and debt stakeholders are able to free capital from underwater assets, it will remain difficult for them to deploy capital even into great 2024 deals.

In summary, the hangover of heightened interest rates and construction costs has already passed. However, we still need to weather the land cost and capital supply hangover to return to a bullish market.

Conclusion

The outlook for 2024 is brighter than 2023. The Fed indicating that rate hikes have stopped should enable the land cost and capital supply hangover to begin to work itself out. We believe leading firms will continue to invest in technology in order to ensure efficiency and operational excellence for years to come.

To support this aim, Rabbet will continue to invest in Real-time Insights, Robust Controls, and Deeper Connectivity.

- Real Time Insights not only on costs, but actions, controls, and schedules.

- Robust controls, not only on invoices, but also your account, your payments and your agreements.

- Deeper connectivity to your other systems and to your other stakeholders to ensure clear concise efficient collaboration across your project team.

New opportunities await the CRE industry in 2024. We look forward to continuing to support you through these difficult times and beyond.

Jump To