In the ever-evolving construction industry, lenders and developers face ongoing challenges in communication, collaboration, and operational efficiency. The 2023 State of Construction Finance Report, based on a survey conducted by Rabbet, sheds light on the persistent issues faced by industry professionals. However, it also highlights the growing recognition that technology holds the key to solving many of these problems. This blog explores how lenders and developers spend excessive time processing draws on construction projects, the inefficiencies inherent in current processes, and why embracing technology is crucial for streamlining operations and driving future success.

Top Challenges for Construction Lenders and Developers

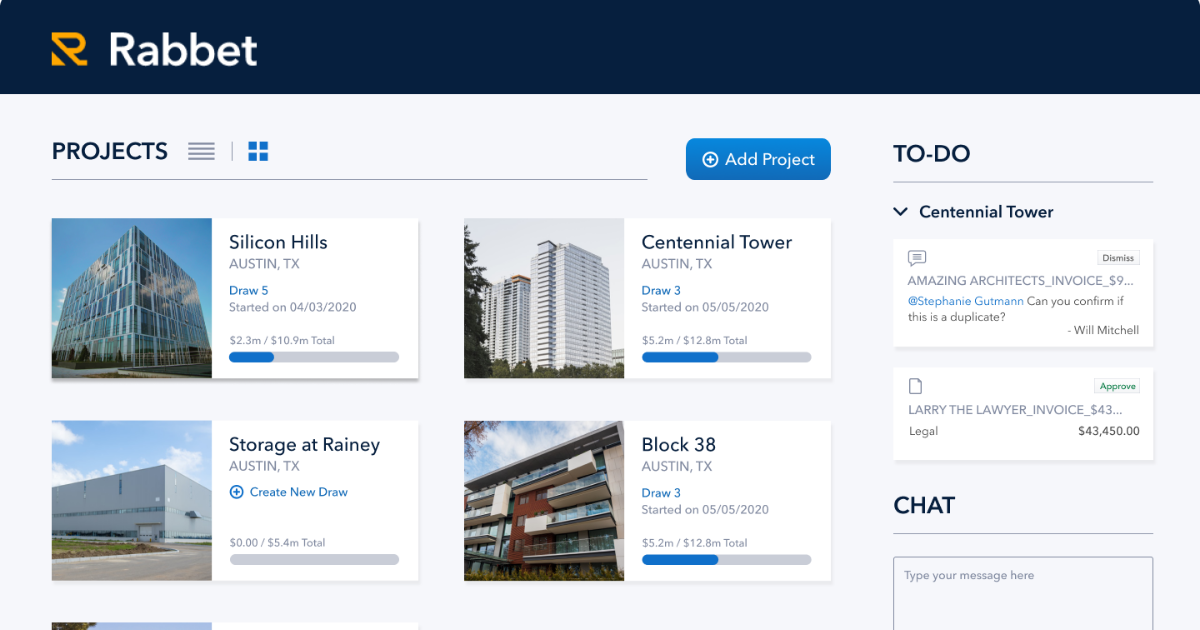

Both lenders and developers have recognized the need to enhance their processes to ensure efficient tracking and access to relevant data. External collaboration, reporting, data analysis, managing risk, and processing draw requests emerged as major challenges for lenders. On the other hand, developers faced difficulties in knowing project finances, managing budgets, and tracking project data in a centralized manner. These challenges emphasize the importance of accurate, real-time, and easily accessible project finance data for developers.

Legacy Software and Manual Processes

Despite the reliance on spreadsheets and accounting systems, the survey revealed that industry professionals consider them unfavorable tools due to their limitations and potential for human error. Developers expressed a need for operational improvements, leading to a significant portion (68%) investing in software implementation and process enhancements over the past year. The industry’s heavy dependence on manual input and legacy software poses risks, increases complexity, and limits efficiency. To ensure security and enhance processes, a shift toward tailored technology is essential.

Mitigating Risk and Minimizing Human Error

Human error associated with manual processes remains a concern for both lenders and developers. The survey indicated an increased recognition of the impact of digital processes on reducing project risk. Lenders acknowledged the need to manage risk and improve their processes through various methods, including technology adoption. Automation, compliance checks, and involving multiple departments in the review process were cited as effective risk management strategies. By minimizing data entry and leveraging automated checks, lenders and developers can enhance accuracy and reduce errors.

Complexity of the Draw Process

The draw process, which plays a vital role in construction finance, continues to be a time-consuming and inefficient endeavor. Developers reported an average wait time of 5 to 6 days for draw funding, highlighting the need for expedited processes. The draw process complexity creates opportunities for information loss, delays, and errors. As the industry recalibrates after the pandemic, operational efficiency becomes even more crucial for winning new business.

Identifying Areas for Automation

Survey respondents expressed a shared belief that automation could significantly enhance efficiency in the construction finance process. Lenders and developers identified areas where automation would have the most significant impact, such as identifying at-risk projects and automating compliance checks. Streamlining reporting and automating month-by-month cash projections and forecasting were also high-priority areas for lenders and developers, respectively.

Investing in the Future

Amid the uncertainties posed by the macroeconomic environment, both lenders and developers are reevaluating their processes to ensure stability and adaptability. The survey revealed a growing recognition of the need for digital transformation to stay competitive. The construction industry is embracing technology to modernize long-standing processes and enhance operational efficiency.

Conclusion

The construction industry is at a turning point, recognizing the need for technology-driven solutions to overcome the challenges faced by lenders and developers. By embracing automation, streamlining reporting, and leveraging tailored technology, construction professionals can minimize inefficiencies, reduce human error, and improve collaboration and communication. The future of construction finance lies in technology, offering the potential for increased efficiency, accuracy, and success in an ever-changing industry.

Download Rabbet’s 2023 State of Construction Finance Report here. For more information about Rabbet, visit rabbet.com.

Rabbet is transforming the construction finance industry with tailored solutions that provide a complete picture of construction and asset management portfolios. Designed for real-time workflows and comprehensive insights, Rabbet enables real estate developers, construction lenders, and related service providers to lower operational costs, make more informed decisions, and earn trust with other financial stakeholders. Founded in Austin, TX in 2017, Rabbet has improved visibility and efficiency for over $50B in construction and capital expenditure projects.